For many years, the realm of gaming stocks was primarily ruled by casino shares and, to a smaller degree, vendors. In recent years, this has shifted due to major inputs from online sports wagering and real estate firms.

In the realm of publicly traded casino landlords, there are only two names to consider — VICI Properties (NYSE: VICI) and Gaming and Leisure Properties (NASDAQ: GLPI). These real estate investment trusts (REITs) are offshoots of casino companies. VICI was divested from Caesars Entertainment (NASDAQ: CZR), and Gaming and Leisure was created from Penn Entertainment (NASDAQ: PENN).

Their business approach attracts numerous investors. Both REITs do not depend on casino attendance or player misfortune at the tables. Instead, they gather rent, which tenants (gaming companies) must pay, potentially leading to considerable harm to their credit ratings. Moreover, it is the tenants — not GLPI or VICI — who are accountable for improvements and upkeep at the properties.

"In 2023 alone, VICI's revenue surged by 35.8%, largely thanks to its aggressive acquisition strategy,” noted Drew Anderson, product analyst at VanEck. “They’re not just snapping up casinos either — VICI has diversified its revenue streams beyond traditional gaming activities, scooping up assets like Bowlero bowling centers and the Chelsea Piers complex in New York.”

VICI holds the title of the largest proprietor of casino real estate on the Las Vegas Strip, owning the property holdings of renowned locations like Caesars Palace, MGM Grand, and the Venetian.

Additional Advantages of Casino Real Estate Stocks

Gaming and Leisure along with VICI provide investors various additional advantages. Market participants tend to prefer the wider universe of REITs during periods of rising inflation, like in 2022 and 2023, since landlords typically incorporate inflation escalators into tenant agreements, which applies to gaming REITs as well.

Furthermore, REITs of every kind are sensitive to interest rates, indicating that the stocks typically react opposite to the rates. After a reduction of 50 basis points in September, the Federal Reserve decreased rates by 25 basis points earlier this week. Next, there are the extensive lease agreements that gaming firms enter into with entities such as GLPI and VICI. This simplifies the process of predicting future profits and cash flow for analysts and investors.

“These long-term leases ensure that the tenants (the casino operators) are responsible for virtually all expenses, from taxes to maintenance. Rent escalation clauses are also baked into lease agreements, which means GLPI and VICI sit back and collect steady rent checks, giving them a predictable revenue stream that’s less volatile than the ups and downs of daily gaming activity,” added Anderson.

Since their separation from those casino companies, both VICI and Gaming and Leisure have surpassed Caesars and Penn in performance.

Online Sports Wagering an Industry Leader in Growth

Following the 2018 Supreme Court decision regarding the Professional and Amateur Sports Protection Act (PASPA), 39 states and Washington, DC have legalized various types of sports betting, boosting interest in shares such as DraftKings (NASDAQ: DKNG) and FanDuel's parent company Flutter Entertainment (NYSE: FLUT).

Currently, those two firms dominate the US sports betting market, which has surged due to numerous states allowing mobile and online gambling, eliminating the need for trips to physical sportsbooks.

“The internet has fundamentally reshaped gambling, and the old stereotype of gamblers traveling to casinos is becoming increasingly outdated,” observed Anderson. “Sports media outlets cover the betting odds of every event. With the rapid expansion of online gaming and sports betting, the action has moved from the neon-lit Strip to the palm of your hand.”

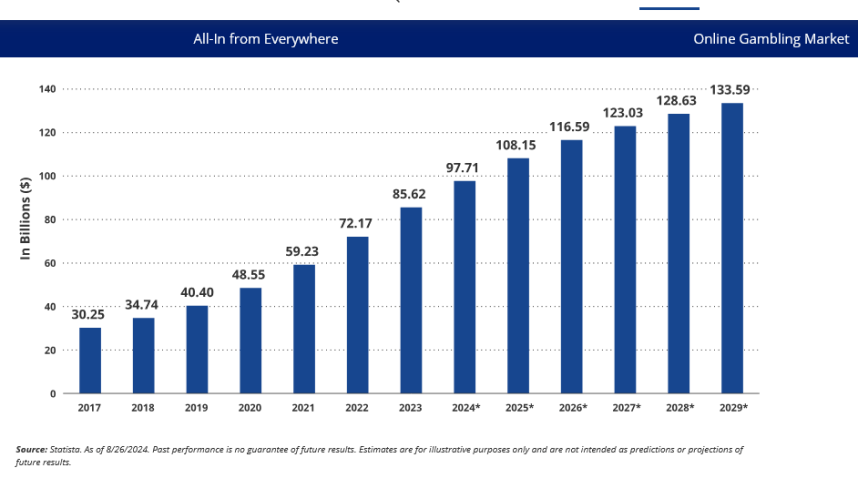

As indicated by the chart above, online gambling is on the rise and this trend is anticipated to persist, especially if additional states authorize iGaming alongside sports betting.